Reigo’s Algorithm

Over two decades of data model processing

We use over 300 external data points covering two decades in real estate short term loans including the 2008 recession and Covid-19 period.

The data integrates information on the borrower, the capital stack, the loan terms, the property and the market, both local and national levels including marco indicators as well.

We apply this data to a proprietary historical database of over 600,000 short-term loans to gain insights and predictions allowing investors to dramatically reduce the potential of investing in a non-performing loan.

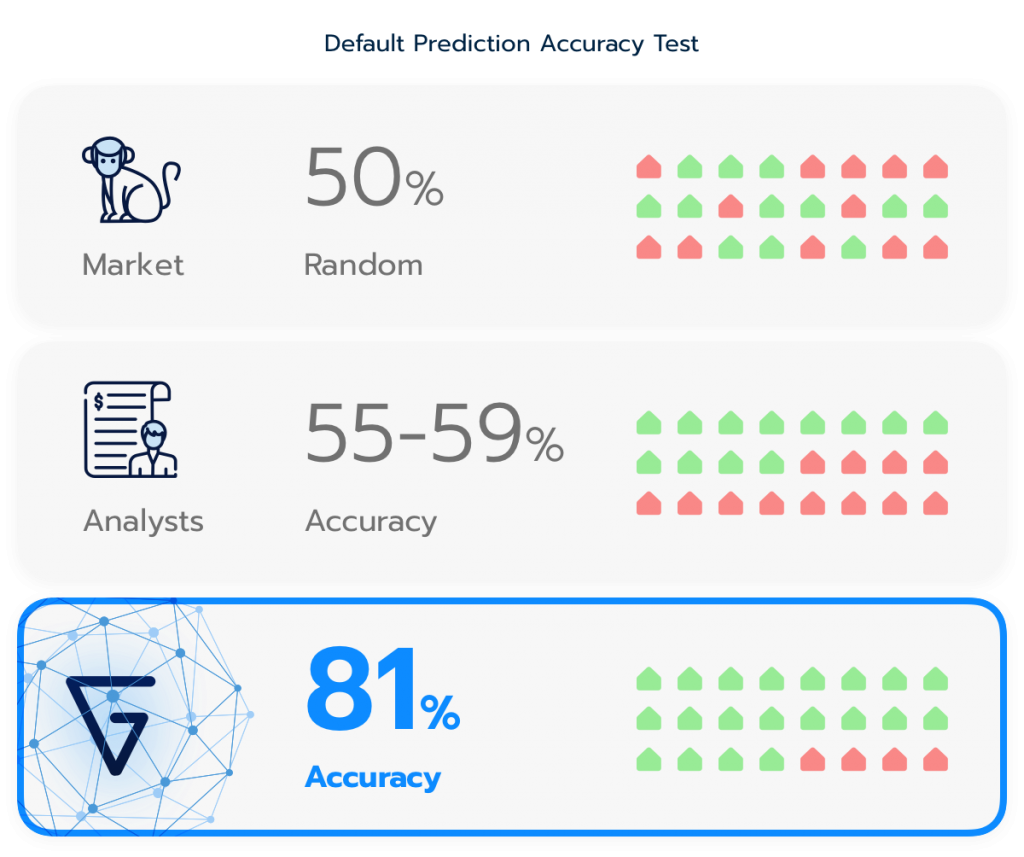

Achieving the highest accuracy

By using several types of machine learning models (linear, random forest, and neural network), we have built the Reigo risk exposure index.

This index analyzes an investment opportunity to help us predict the probability of an investment going into a non performing status, possible recoveries in such a case, together with the main pros and cons of the deal.